Understanding Property Tax in Texas

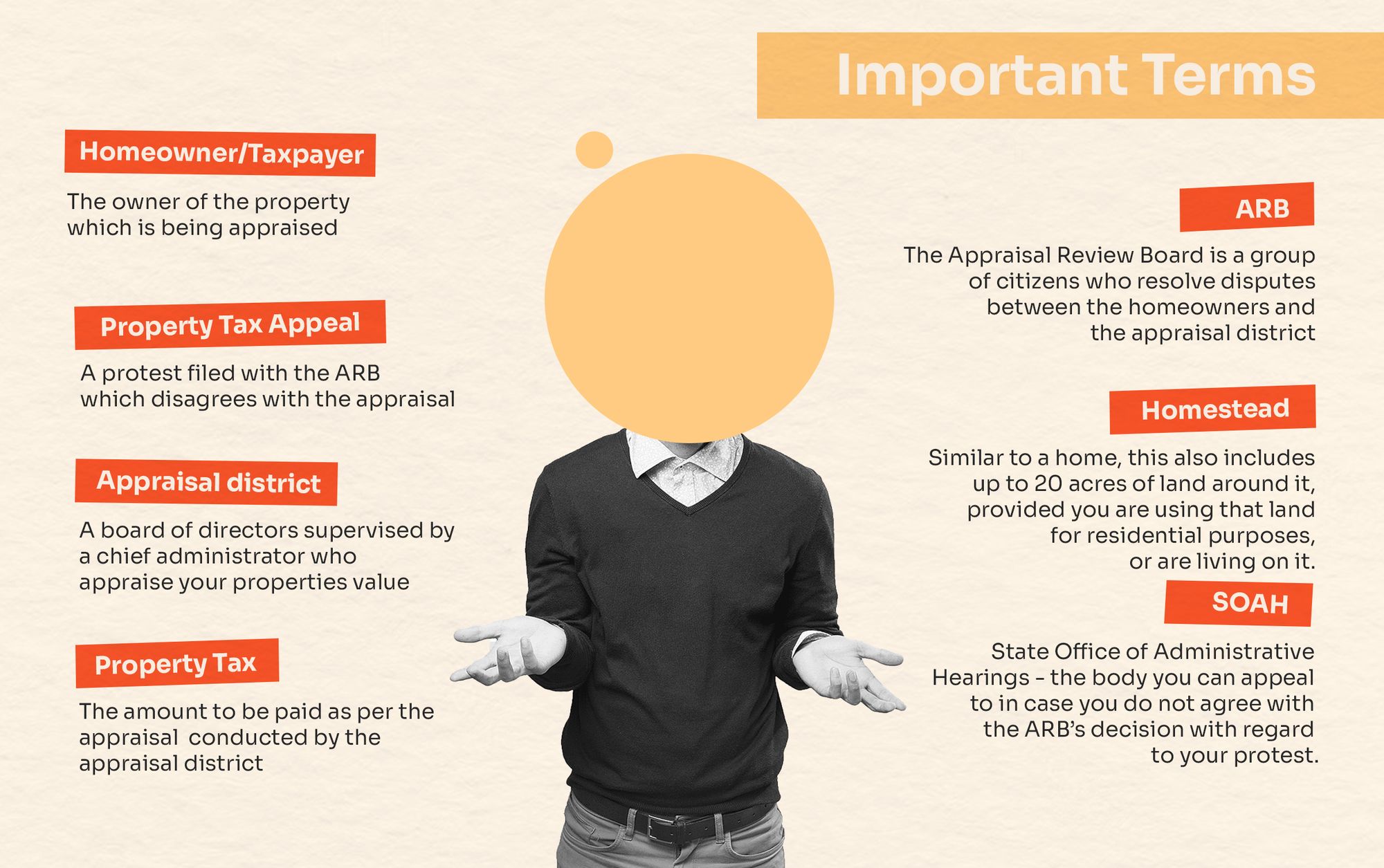

As a first-time homeowner, there are some hidden costs associated with owning property. For instance, paying property taxes. Now, what is it and how does it apply to you? Property tax is an amount that is calculated on the basis of the value of the property owned by the taxpayer or homeowner. Property taxes can be seen as a two-part amount: the first is the basic amount, which needs to be paid; the second is a variable amount, which is calculated based on the value of your property.

Property taxes are used by local governments to pay for essential services, such as schools, police, fire protection, and road maintenance. In Texas, you don’t have to pay any state tax for properties. However, as per the Texas Constitution and statutory law, local governments are authorized to collect property taxes. So, the setting of the rates, settling of disputes and collection of taxes are all undertaken by a taxing unit, including cities, school districts, counties and others.

What is a Property Tax Appeal?

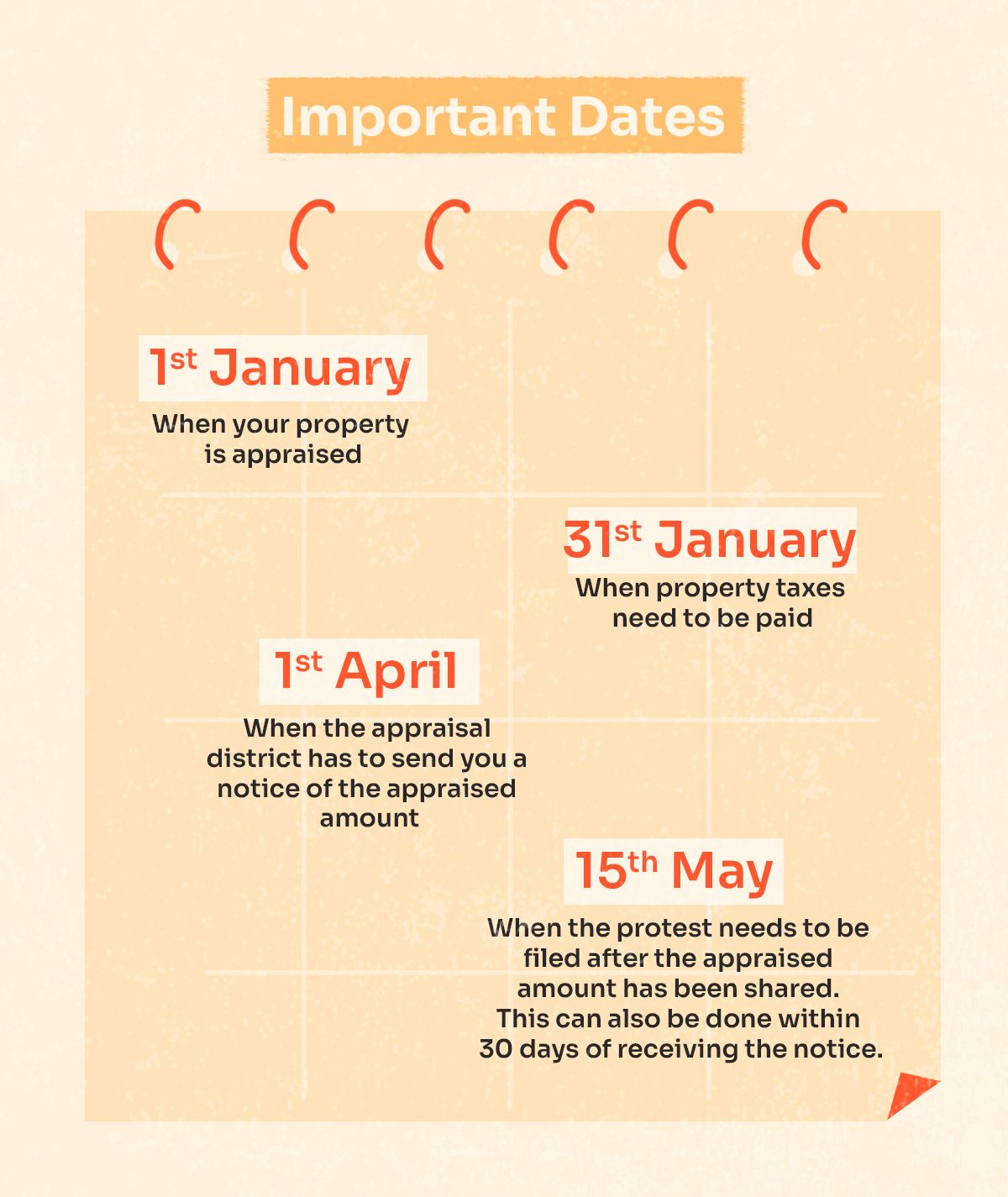

When a homeowner doesn’t agree with the property tax being levied or the valuation of their property, they can raise an appeal with the ARB. While the appraisal district evaluates your property valuation on the 1st of January every year, the ARB is a group of local citizens who hear and settle disputes between homeowners and the appraisal district regarding how much tax is being imposed or what a property’s value may be.

Once disputes have been settled and the taxable amount has been shared with the homeowner, they are expected to make payments by the 31st of January of the following year. In case this deadline is not met, there are penalties and interest charges that will start to accumulate on unpaid tax bills. What happens if you don’t agree with the ARB’s decision? As a homeowner, there are a few options open to you, and we’ll get into those later in the article.

On What Grounds Can I Protest Property Taxes?

There are several reasons why a homeowner may not agree with the tax being levied on their property. Below are a few of the most common reasons:

Incorrect Property Assessment

One of the most common reasons for Property Tax disputes is when the tax is calculated based on old or obsolete data. Incorrect assessment can include changes to the condition of your property that haven’t been considered. It may also occur when similar and nearby properties to yours are taxed at very different rates.

Administrative Errors

If your property has been taxed by the appraisal district without valid exemptions or inaccurate property descriptions, you can challenge the tax and file a property tax appeal.

If You Were Not Notified

If the value of your property has increased from the previous year, the appraisal district must send a notice by the 1st of April (or 1st of May for non-homestead owners) regarding the appraised amount. This notice should also contain instructions on how to file a protest with the ARB, as well as instructions on how to have an informal interaction with the appraisal district before the ARB hearing. If this is not done, or if you disagree with the appraised amount, you can appeal to the ARB.

Discriminatory Appraisal

Do you feel like the tax assessor has unfairly discriminated against or used arbitrary methods to evaluate your property? If so, then you definitely have valid grounds to protest.

Modifications to Property Condition

Tax assessors often don’t take into account changes to the property, such as damages caused by natural disasters or even the general deterioration of the neighborhood. These factors would also be grounds for an appeal.

These are the most likely reasons for you to file an appeal, but there may be other scenarios where filing an appeal is justified.

How Do I File A Protest?

To protest the value of your property on your tax bill or fix errors in the property's records, you need to fill out this form and send it to the ARB. You usually have until May 15 or 30 days from receipt of the notice from the appraisal district, whichever is later, to start the protest process.

In Section 3 of the form, you must explain why you're protesting. You can also choose someone to speak for you at the protest hearing. Once you've sent your protest, the ARB will let you know when and where the hearing will be held.

Before the formal hearing, you can try to solve the issue by speaking with the appraisal district in person. If that doesn't work, you can proceed with the formal hearing. During the hearing, both you and the person in charge of property values will explain your respective arguments and evidence. The decision made by the ARB is only valid for that tax year.

In short, if you're not happy with your property's assessed value or if there are errors in your property records, fill out Form 50-132 and send it to the ARB.

Tips To Help File A Protest

Once you’ve decided to file a protest, you should:

- Ask one of the appraisers to explain the appraisal to you in detail.

- Ensure the property descriptions and measurements provided are correct.

- Check for any hidden defects to your property that haven’t been covered, such as roof leaks or structural damage. You can maintain proof of this damage via pictures or a statement from an independent appraiser or builder.

- Go through the records of appraisals of similar properties to see if they've been appraised in a similar way.

- Sometimes, getting an independent appraiser to look at your home may help with your appeal.

- Focus on gathering information about the sale of similar properties in your area. This information can help you prove how the evaluation of your property tax has been assessed at a higher value or that the assessment is inaccurate.

- Sales information can be collected in the form of sworn statements or any pertinent documents.

- Also, focus on properties that have been sold closer to the 1st of January, as that’s when your property is usually assessed.

- Don’t forget to get all the information used to evaluate your property tax from the appraisal district. While this information is usually considered confidential, it must be made available to you in the case of a property appeal.

- The appraisal district is going to produce schedules, data, or formulae at the hearing; this information will be made available upon request 14 days prior to the hearing. Make sure you are familiar with all the information that will be presented.

- When requesting copies of this information, you may need to pay for the copies required; however, homeowners cannot be charged more than $15 for each property appeal.

In case you want professional help, experts at Bezit can help you understand your property appeals. We also guide you through filing an appeal, even if the tax benefit received is a small one. You can’t put a price on justice, right? If you’re convinced—and the experts are—you know that you need to file a protest.

What Happens Next?

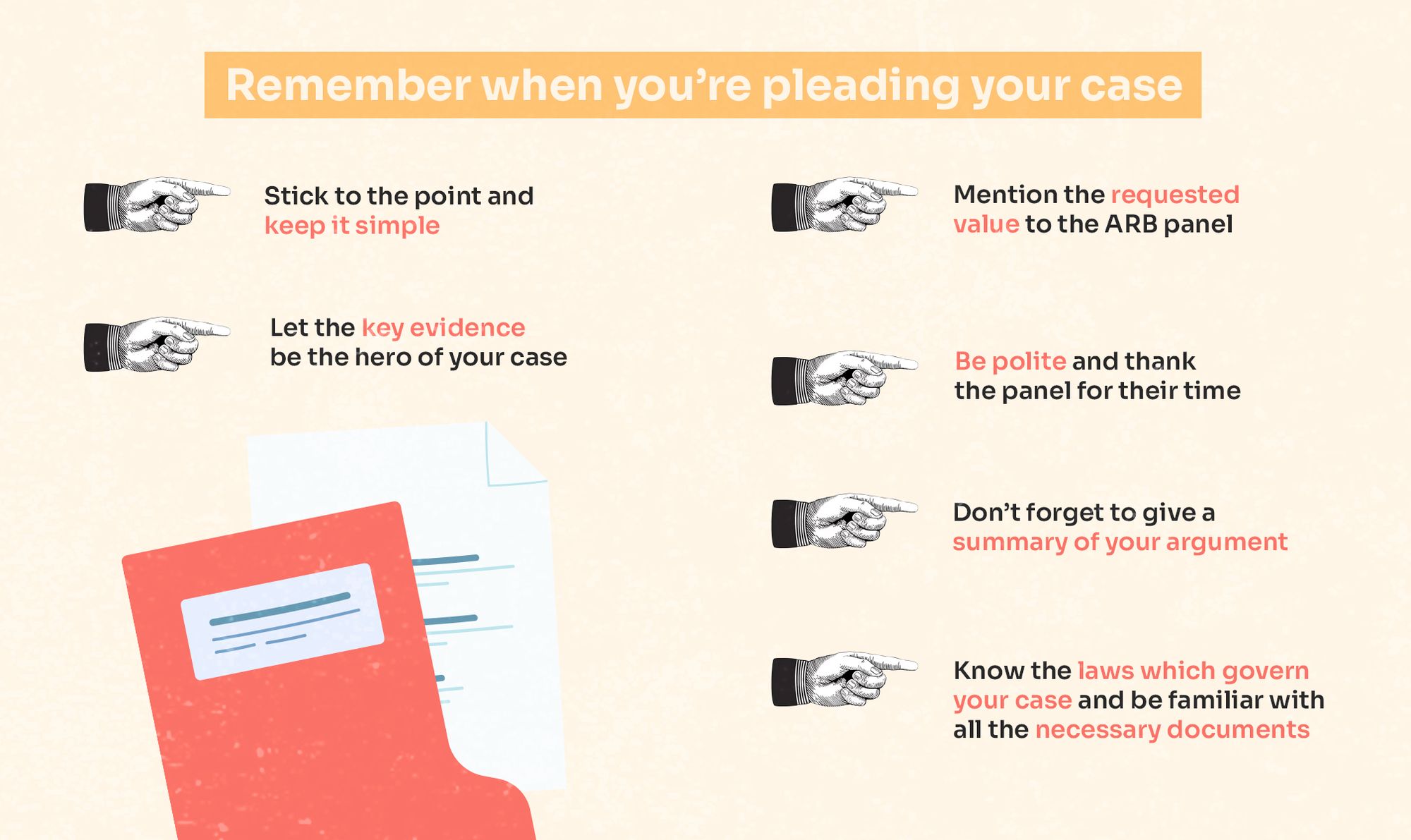

Once you’ve decided to file a property tax protest and set an appeal in motion, it’s simply a matter of having to convince the ARB that the dispute is a valid one.

- The ARB sets a date for the hearing

- You present your case and rebuttal evidence is given

- Individual parties make their closing arguments

- After the hearing, the panel deliberates and then votes on the issue

- The final outcome is announced.

If you’re not in agreement with the results, you have 3 options:

- Binding Arbitration

If you qualify for a binding arbitration, which is conducted by an independent 3rd party, you may request this. - District Court

You can also challenge the outcome in the state district court of the county within which the property is located. - State Office of Administrative Hearings (SOAH)

If the value of the property exceeds $1,000,000, you can also appeal to the SOAH. Here’s what you need to know about filing with the SOAH.

Important note: There will be a partial payment that needs to be cleared by the delinquency date, even if you want to challenge the ARB’s decision. Remember when we said that there were two components to your property tax? The payment due is usually the portion of tax that you aren’t disputing in your protest, namely the basic amount.

In conclusion, if you feel that you’re not being taxed correctly by the appraisal district, you have options and can definitely file a protest! However, make sure that you have a solid case backed up with evidence and data.

No matter what, Bezit will always be there to help you understand property taxes better! If you feel that you still need more details to properly file your property tax appeal, you can reach out to your local appraisal district for clarification.