A primary place of residence that someone owns is called a homestead, and losing it can be devastating. Unfortunately, this is a reality for those who are unable to pay their property taxes or forced to file for bankruptcy. It is not only a financial loss for the person and their family, but also a devastating emotional experience. As a homeowner, you must be wondering whether there is anything to be done in the face of a serious financial setback. Fortunately, there are homestead exemptions offered in many states in the United States of America, which you can use in the case of a financial setback.

Let’s start by understanding the term – “homestead exemptions”. What are homestead exemptions? These are legislative policies that allow homeowners to protect a certain portion of their primary residence from the claims of creditors. Based on the law of each state, there is a certain amount of property value that creditors can’t touch – even in the case of bankruptcy.

You may have also heard this term when paying your property taxes; in that case, it refers to a deduction in your taxes that you can apply for. What we’re talking about here are definite laws that protect a certain portion of your property from being seized in the case of financial shortcomings.

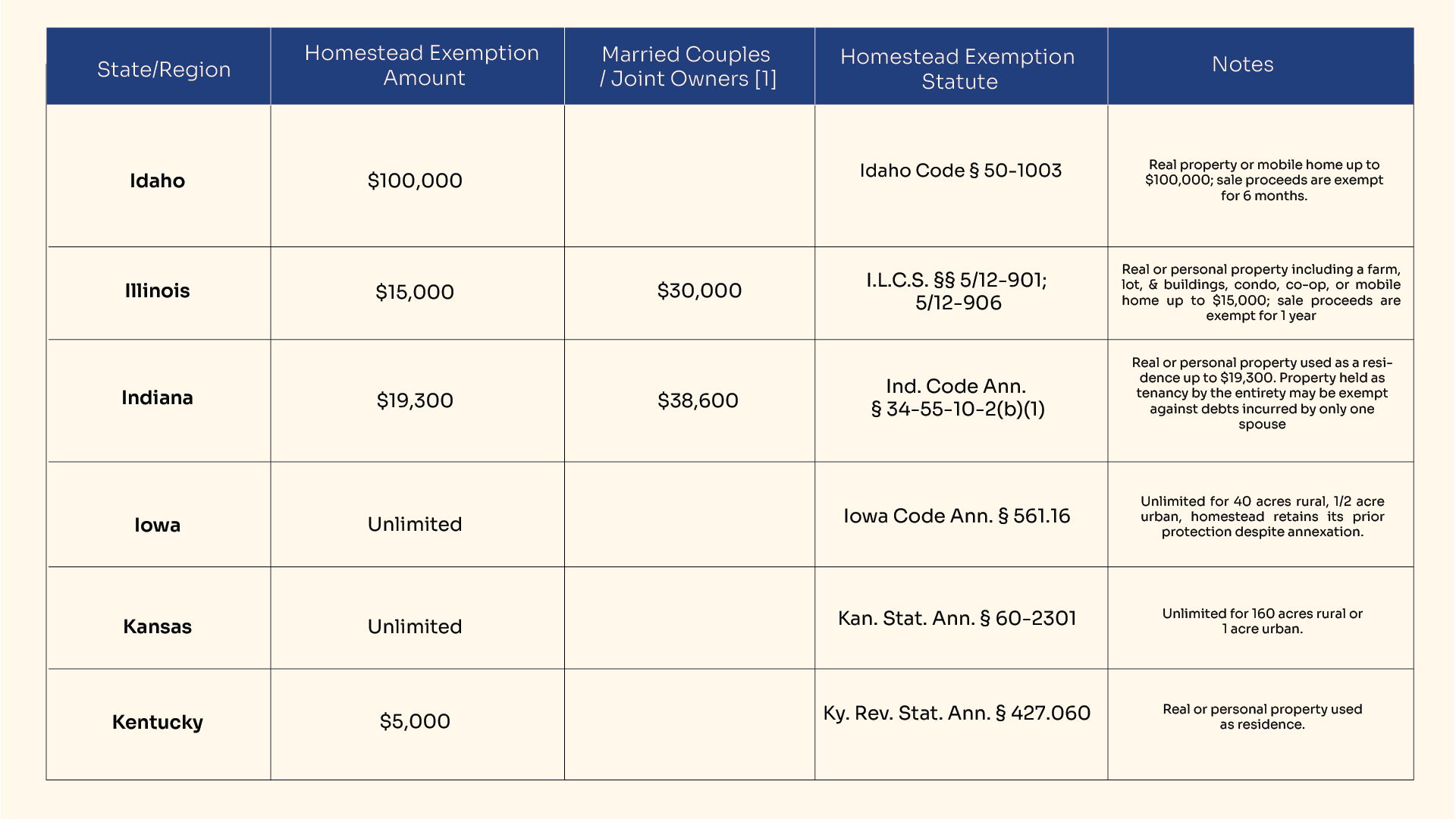

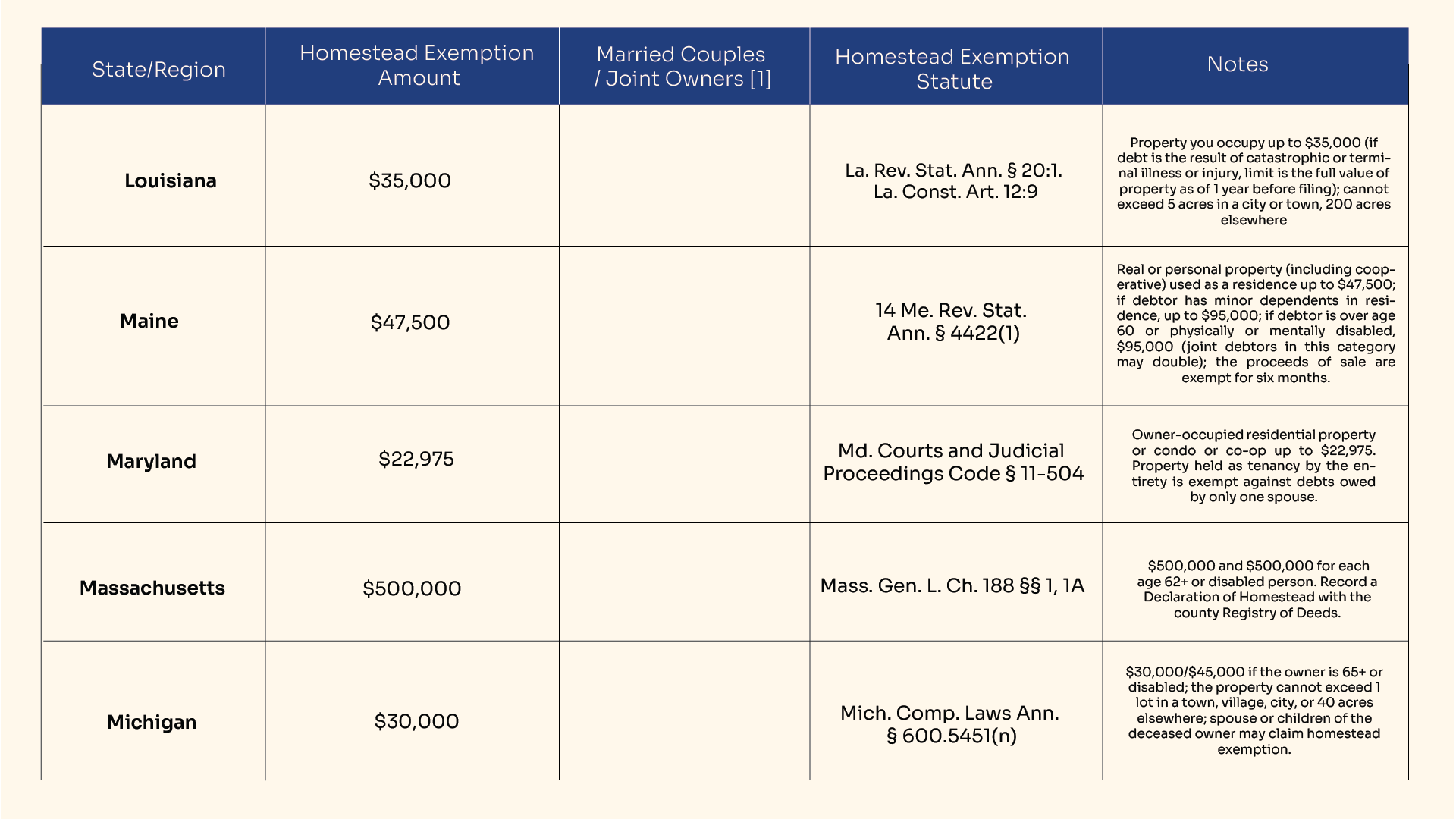

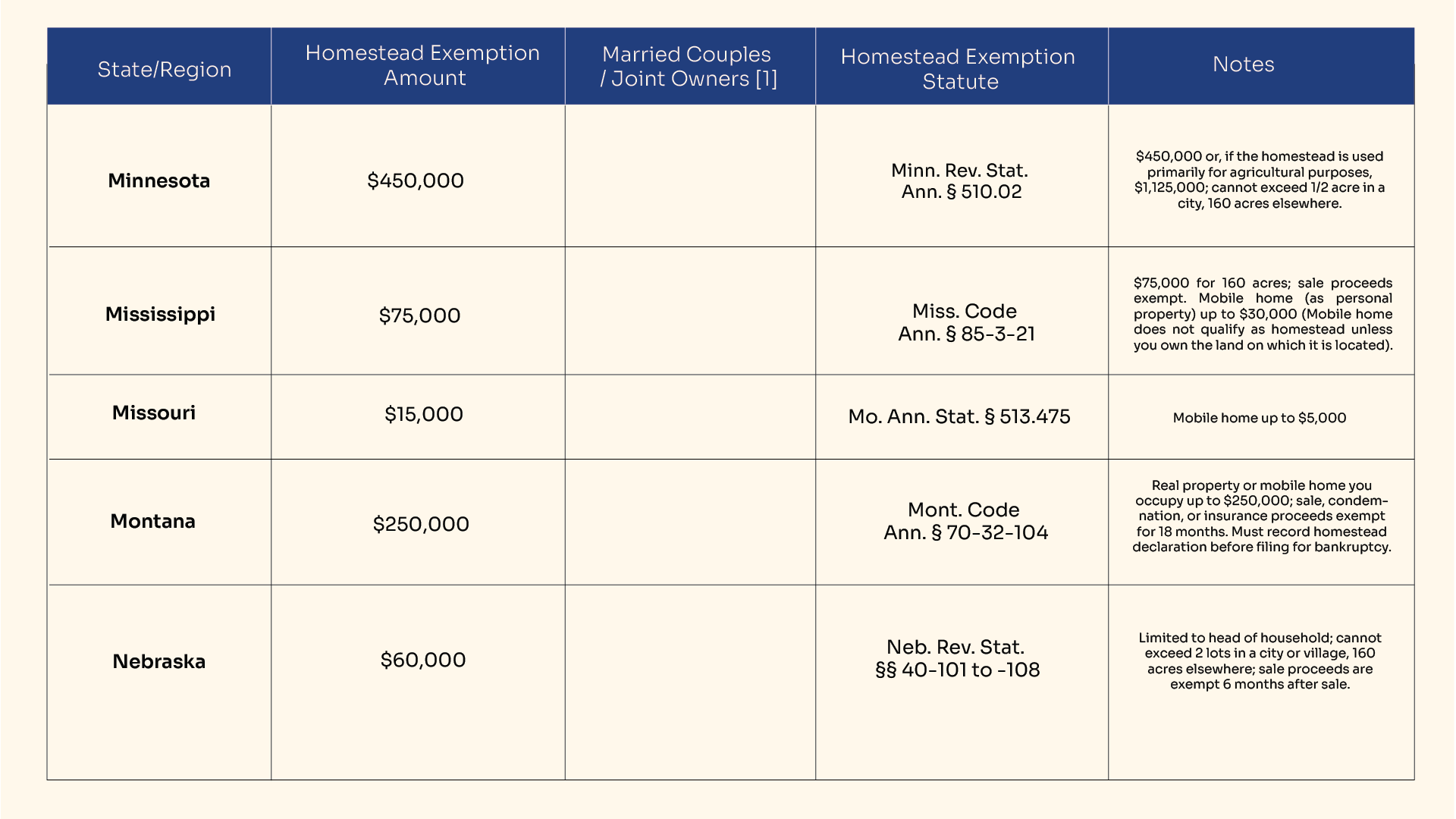

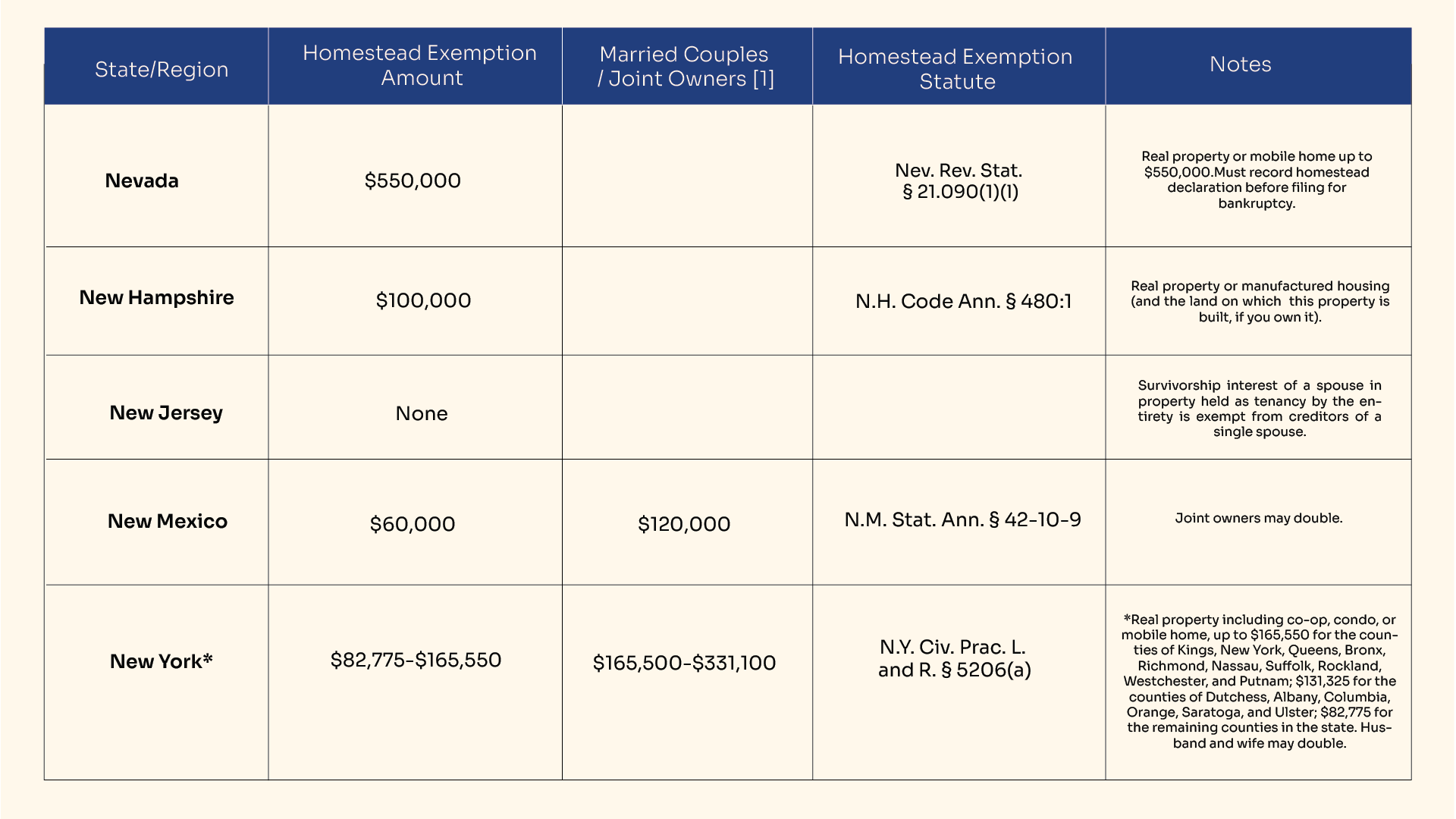

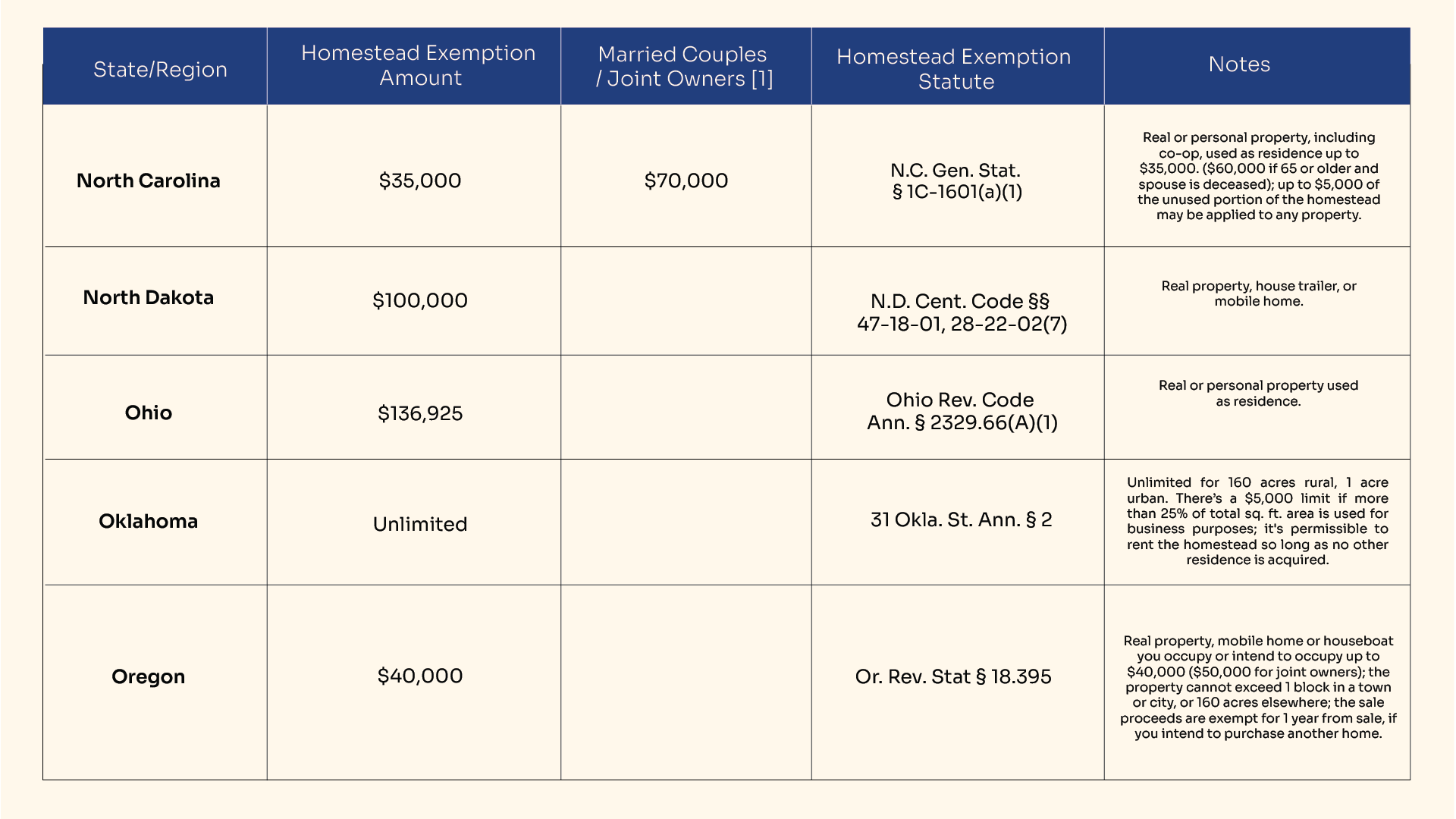

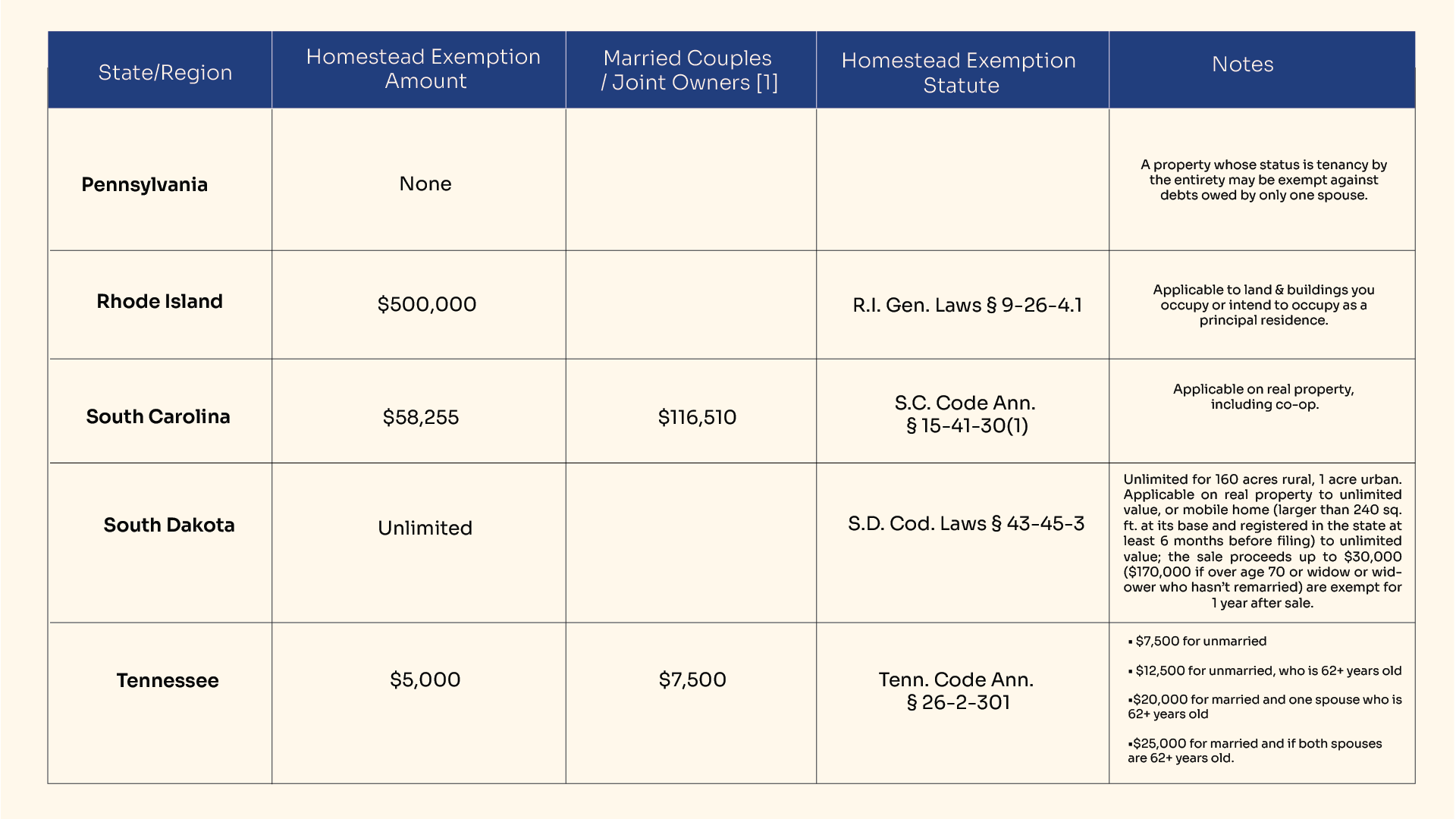

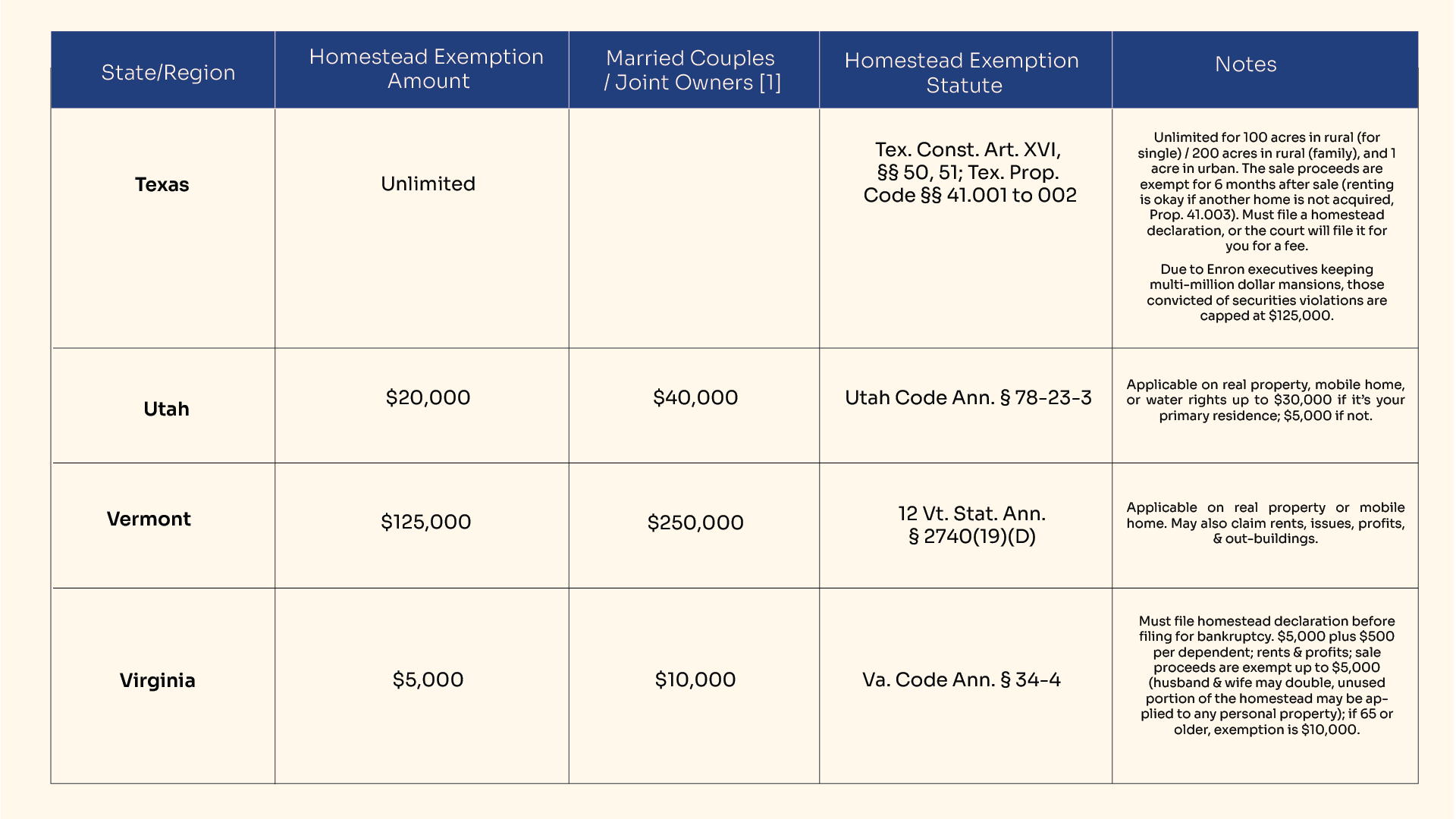

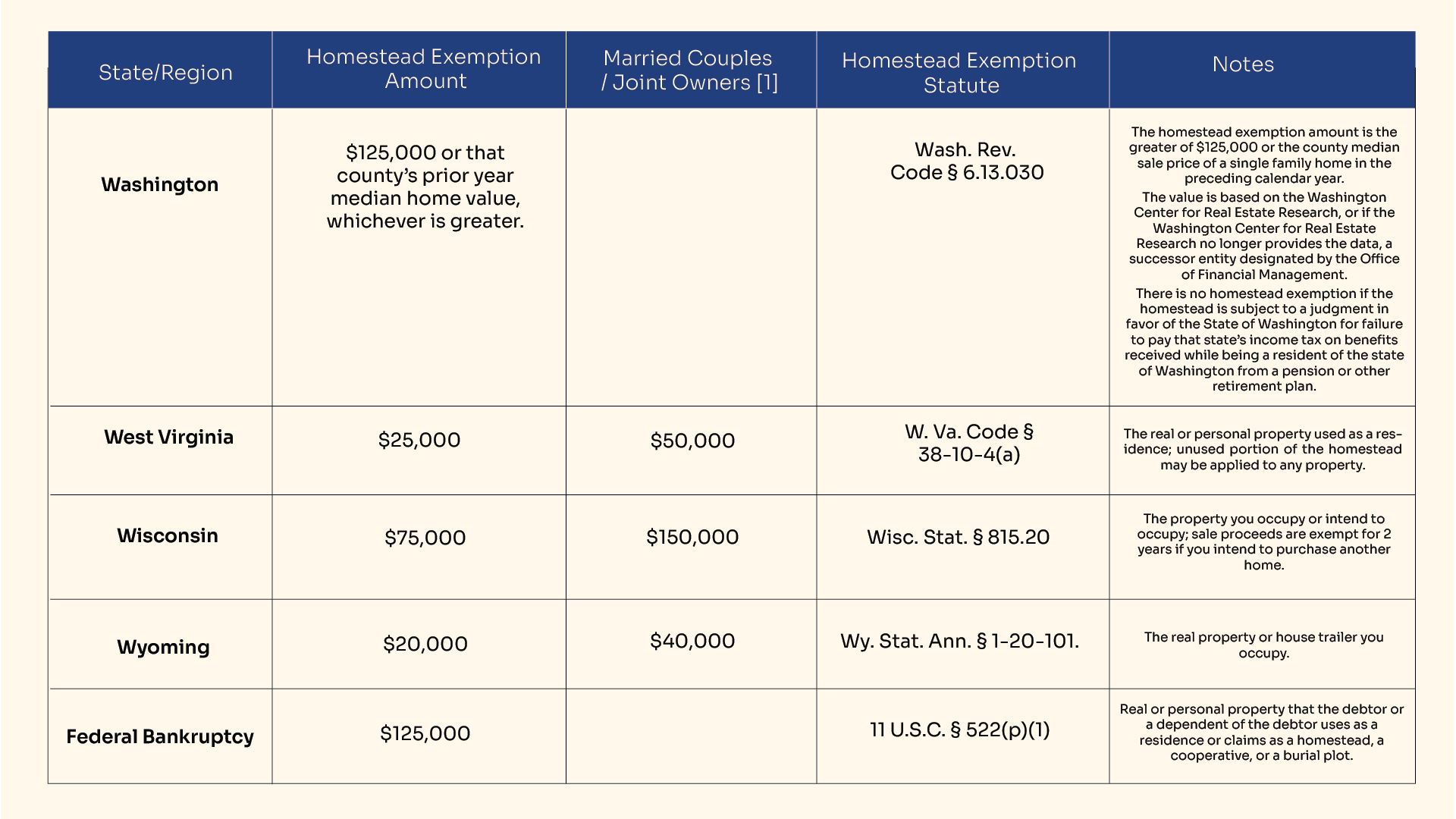

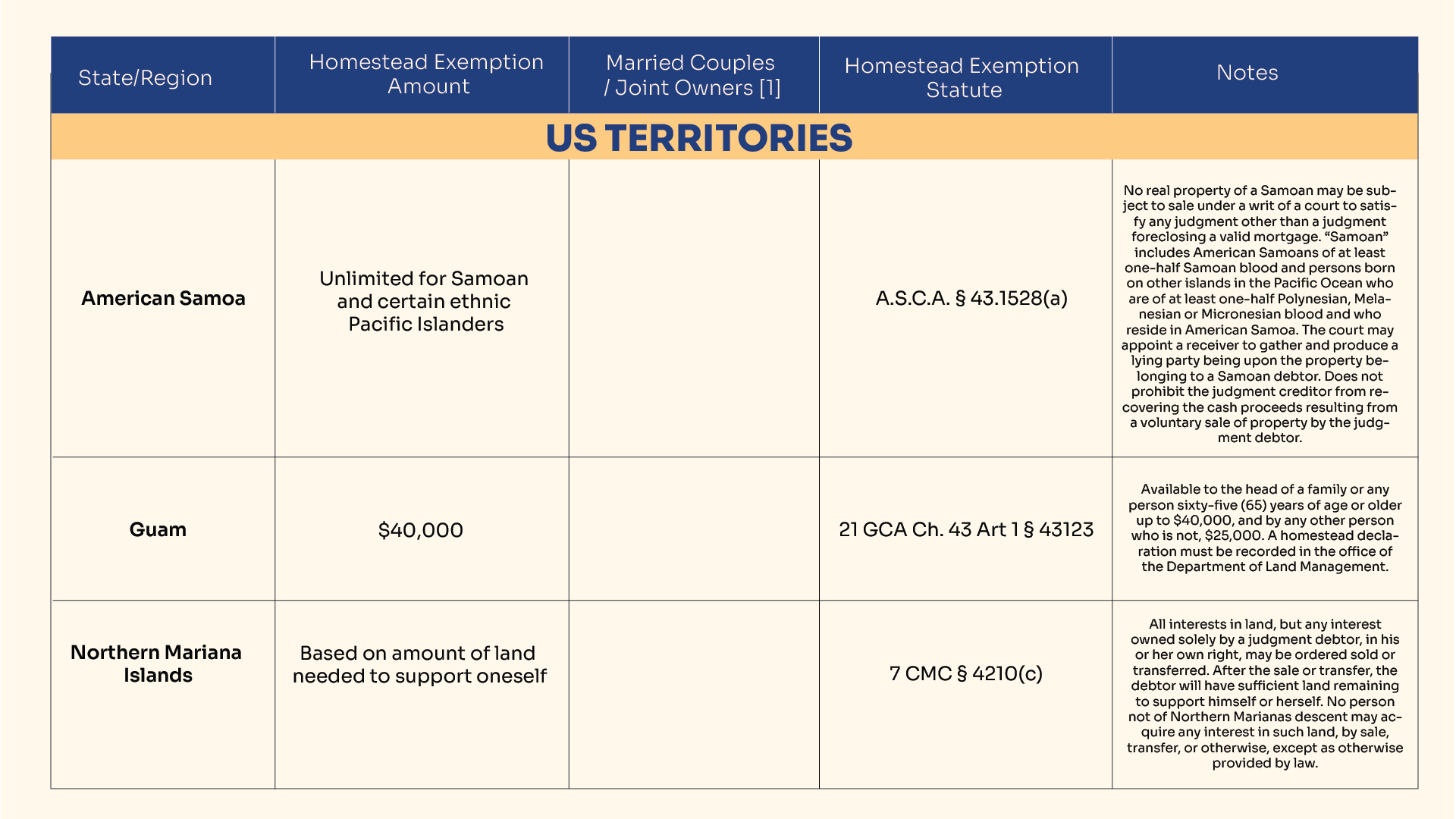

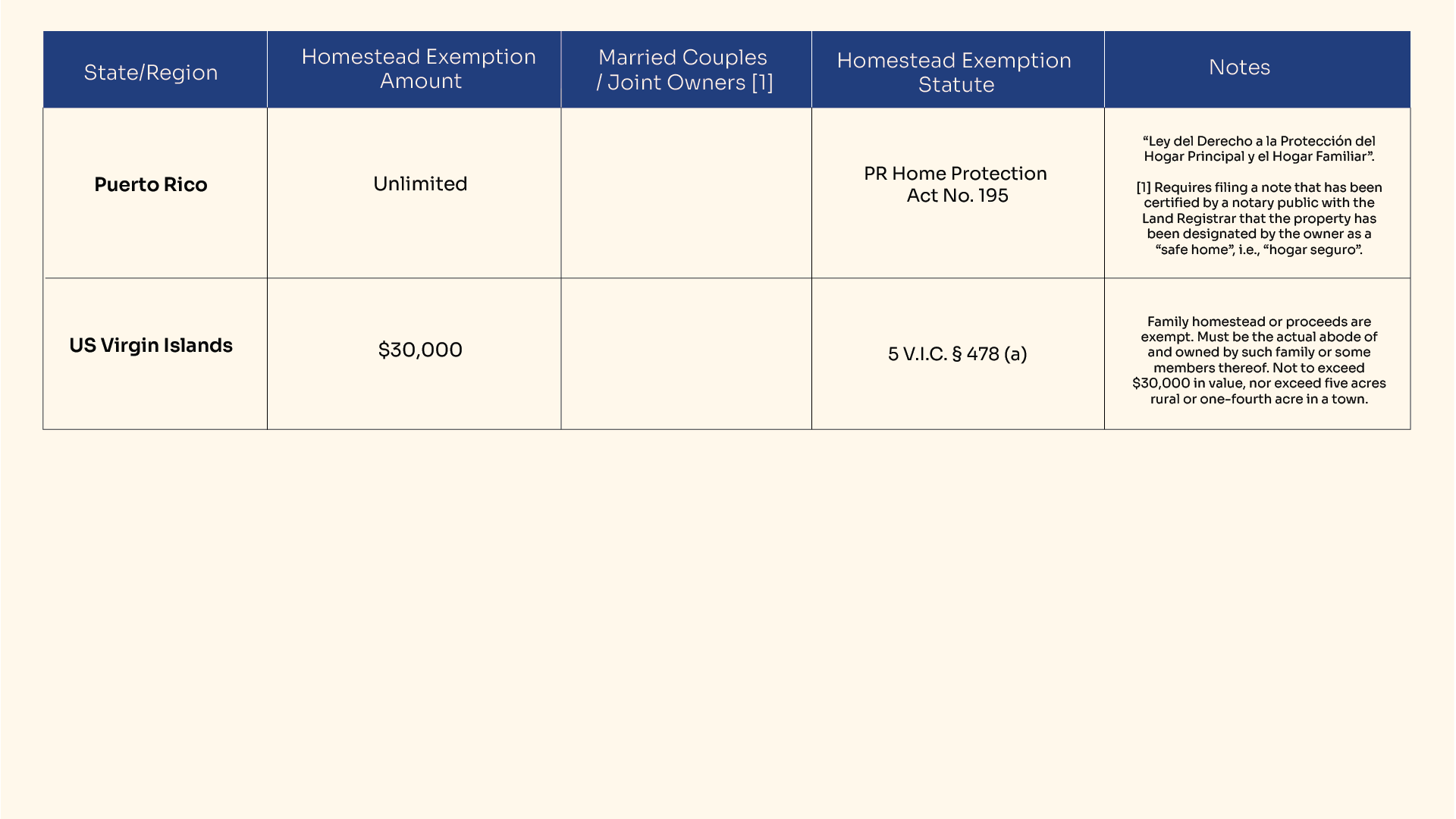

The main question is “can someone take your home away if you’re sued?” The simple answer is yes, but a certain portion of it can be protected by your state's homestead exemption laws. With that in mind, let’s look at the different homestead exemptions by state as of 2023.

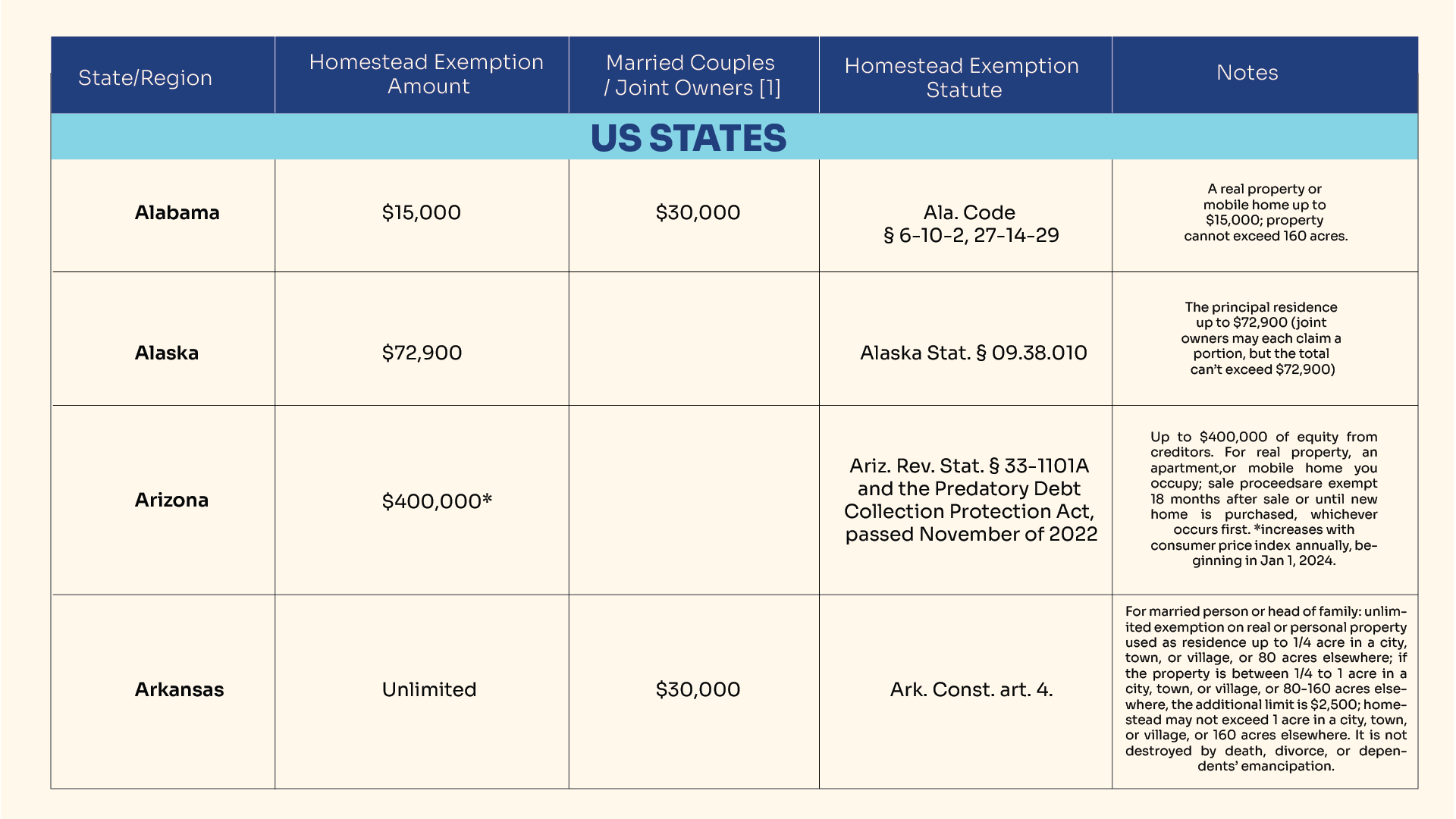

[1] Where there is no increase allowed for married couples or joint owners, the column is left blank and/or referred to in notes.

While this article gives you a general idea of the homestead exemptions by state for the year 2023, remember that these laws are regularly revised. Therefore, it’s wise to consult tax experts who can help you understand the current market value in the state where you live. You can also learn more about individual state exemptions on various online articles.

Secure your living conditions in the United States of America by knowing your rights as a homeowner and remember to stay up to date with all the homestead exemption laws in your state!