-

Master Property Taxes in Texas: Explore our in-depth guide covering everything from understanding property taxes to exemptions, assessments, and payment options. Navigate Texas property taxes with ease.

In this comprehensive guide, we cover everything you need to know about property taxes in Texas.

Understanding Property Taxes: A Brief Overview

When you know what you’re paying for and why you’re paying for it, planning your finances is much easier, and that knowledge unlocks new avenues to save and invest. Below, we’ll explain property taxes, how they’re calculated, and how levying property taxes helps local governments.

What are Property Taxes?

Property taxes are local taxes imposed on real estate properties, including residential properties, commercial properties, and vacant land.

According to the official website of the Comptroller of Texas, property tax is determined by the value of the property that each individual owns.

This tax comprises:Part 1) A base amount against which the tax is imposedPart 2) A percentage that determines the amount of tax due

The property tax amount is based on the assessed value of the property and the tax rate established by local taxing authorities. In Texas, while the state doesn’t impose a property tax, it authorizes local governments to set and collect property tax. Local governments include Texas counties, local school districts, cities, and special purpose districts, such as hospitals, junior colleges, and water districts.

The assessed value of a property is determined by the county appraisal district, while the tax rate is set by various local entities, such as school districts, cities, and counties. The tax rate is usually expressed as a percentage of the assessed value of the property.

How are Property Taxes Calculated in Texas?

In Texas, property taxes are calculated by multiplying the assessed value of the property by the tax rate. The assessed value is determined by the county appraisal district, which appraises properties annually.

The county appraisal district takes various factors into account when determining the assessed value of a property. These factors include the:

- location of the property;

- size of the property;

- the current condition of the property;

- any improvements made to the property.

The appraisal district may also consider recent sales of similar properties in the area to determine the fair market value. This assessment process ensures that the property is valued fairly and accurately.

Please note that property taxes in Texas can vary significantly from one county to another. This is because each county has its own appraisal district and sets its own tax rates. These rates can vary depending on the location and the local taxing authorities' budgetary needs. Therefore, homeowners in different counties may experience different property tax burdens.

Why Do We Need Property Taxes?

Property taxes play a crucial role in funding public services and infrastructure in Texas communities. They enable local governments to provide essential services like education, public safety, and transportation.

Without property taxes, local governments would struggle to maintain and improve public services, leading to a decline in the quality of life for all residents. Property taxes ensure that communities have well-funded schools, well-maintained roads, and adequate emergency services.

In addition to funding public services, property taxes also serve as a mechanism for wealth redistribution. By taxing properties based on their assessed value, property owners with higher-valued properties contribute more to the community's tax revenue. This helps ensure a more equitable distribution of the tax burden.

Property taxes also affect the value and affordability of real estate in Texas. They can impact your monthly mortgage payments, property value, and even the resale potential of your home.

For homeowners, property taxes are an ongoing expense that should be factored into their budget. Understanding how property taxes are calculated and how they may change over time is essential. Being aware of potential increases in property taxes can help homeowners plan and avoid financial surprises.

The Basics of Texas Property Taxes

Now that we have covered the fundamentals, let's dive into the specifics of property taxes in Texas. Understanding how property taxes are calculated and who is responsible for paying them is crucial as a homeowner in the Lone Star State.

Who is Responsible for Paying Property Taxes?

As a property owner in Texas, you are responsible for paying property taxes on your real estate. If you have a mortgage, your lender may collect property tax payments through an escrow account on your behalf.

Even if your mortgage lender pays your property taxes, you remain ultimately responsible for ensuring they are paid in full and on time. Failing to do so can lead to penalties, interest, and potentially even foreclosure.

Property taxes are typically due annually, and the payment deadline varies by county. It's important to stay informed about the specific deadlines and make timely payments to avoid any issues. Some counties may offer the option to pay property taxes in installments, while others require a lump sum payment.

In addition to the regular property tax payments, homeowners in Texas may also be subject to special assessments or fees for services such as trash collection, water, and sewer. These additional charges are usually billed separately from the property taxes.

However, certain exemptions and deductions may be available to homeowners in Texas, such as the homestead exemption, which provides a reduction in the assessed value of a primary residence. Homeowners should explore these options to potentially lower their property tax burden.

Overall, if you understand the intricacies of property taxes in Texas, you can effectively manage your financial obligations. By staying informed about the calculation methods, payment responsibilities, and potential exemptions, you can navigate the property tax system with confidence.

The Role of County Appraisal Districts in Texas

County appraisal districts play a pivotal role in determining property values and assessing property taxes in Texas. They are responsible for accurately assessing the value of properties within their jurisdiction. They gather data on market conditions, property characteristics, and other relevant factors to determine the assessed value of each property. This assessed value serves as the basis for calculating property taxes.

How County Appraisal Districts Determine Property Value

County appraisal districts assess the value of properties based on market conditions and other factors. They use various appraisal methods, including sales comparison, income, and cost approaches, to determine the assessed value of a property.

A sales comparison consists of assessing similar properties that have recently been sold in the area to determine a fair market value for the property being assessed. This method takes into account factors such as location, size, condition, and amenities to estimate the property's value.

The income approach is commonly used for commercial properties and rental properties. It involves analyzing the property's potential income and expenses to calculate its value. This method considers factors such as rental rates, vacancy rates, and operating expenses to determine the property's worth.

The cost approach is used when there are no recent sales or income data available. It involves estimating the cost of replacing the property and adjusting for depreciation. This method is often used for unique properties or properties with limited market data.

It's important to note that the assessed value may not necessarily reflect the property's market value. County appraisal districts aim to assess properties at their market value, but variations may occur due to factors such as market fluctuations, property conditions, or changes in the neighborhood.

Understanding how the appraisal process works can help you evaluate the accuracy of your property assessment and potentially appeal your appraisal, if necessary.

Appealing Your Property Tax Appraisal

If you believe that the assessed value of your property is incorrect or unfairly high, you may undertake an appeals process regarding your property tax appraisal. This process will require you to gather evidence to support your case and present it to the appraisal review board.

Before filing an appeal, it's crucial to review your property assessment carefully and ensure that all relevant information is accurate and up to date. Mistakes in property characteristics or data can result in an inaccurate evaluation, leading to higher property taxes.

If you decide to appeal, be prepared to provide evidence, such as recent property sales data or a professional appraisal, to support your claim. Gathering comparable property sales in your area or obtaining a professional appraisal can help demonstrate that the assessed value is significantly higher than the market value of your property.

The appraisal review board will evaluate your evidence and make a decision on whether to adjust your property's assessed value. If successful, a lower assessed value will result in a reduction in your property taxes.

It's important to note that the appeal process has specific deadlines and requirements. Familiarize yourself with the rules and procedures set by your county appraisal district to ensure a successful appeal.

By understanding the role of county appraisal districts and the appraisal process, homeowners can take an active role in managing their property taxes. Regularly reviewing property assessments and considering an appeal when necessary can help ensure fair and accurate property valuations.

Understanding Your Property Tax Bill

Once the assessed value of your property is determined, and the tax rate is set, you will receive a property tax bill from the taxing authorities. Understanding the components of your property tax bill and how to read it is essential for effective financial planning.

Property taxes are a significant expense for homeowners, and it's crucial to have a clear understanding of how they are calculated and where your money is going. Let's dive deeper into the components of your property tax bill to gain a better understanding.

Components of Your Property Tax Bill

Your property tax bill will typically include various components, including the assessed value of your property, the tax rate, and the total amount due. It may also detail any exemptions or reductions that may apply to your property.

The assessed value of your property is determined by the taxing authorities based on factors such as the size of your property, its location, and the value of similar properties in the area. This value serves as the basis for calculating your property taxes.

The tax rate, also known as the millage rate, is set by the local government. Additionally, your property tax bill may include separate levies for different taxing authorities, such as school districts, cities, counties, and special purpose districts. These levies are additional charges that are specific to each jurisdiction and are used to fund various public services and infrastructure projects.

Understanding these components will help you interpret your bill and ensure its accuracy. It is important to review each section of your property tax bill carefully to identify any discrepancies or potential errors.

How to Read Your Property Tax Bill

Reading your property tax bill can be overwhelming if you're not familiar with the terminology and calculations. However, breaking it down into sections can make it more manageable.

Start by reviewing the property information section to ensure accuracy. This section includes details about your property, such as its address, legal description, and parcel number. It's essential to verify that all the information is correct to avoid any confusion or potential issues.

Next, examine the breakdown of the tax rates and levies applied to your property. This section will provide a detailed explanation of how the tax rate is calculated and how it contributes to the total amount due. It may also outline any exemptions or reductions that have been applied to your property, such as homestead exemptions or tax abatements.

Finally, calculate the total amount due and verify any exemptions or reductions. This section will provide a clear breakdown of the taxes owed to each taxing authority and the total amount you need to pay. It's essential to double-check these figures to ensure accuracy and avoid any unnecessary penalties or interest.

By taking the time to understand your property tax bill and reviewing it thoroughly, you can make informed financial decisions and plan for your future expenses more effectively.

Texas Property Tax Exemptions and Reductions

Property taxes can pose a financial burden. However, the state provides several exemptions and reductions to help alleviate this burden. By taking advantage of these programs, property owners can reduce their tax liability and keep more money in their pockets.

Homestead Exemption

Homestead exemptions are available to individuals who use their property as their primary residence. It provides a reduced taxable value for the portion of the property used as a homestead, potentially resulting in lower property taxes.

Applying for the homestead exemption is a straightforward process. Property owners need to submit an application to their county appraisal district, along with the required documentation. This exemption is available in all Texas counties, but the eligibility requirements and the amount of the exemption may vary.

Once approved, the homestead exemption remains in effect as long as the property continues to be used as the owner's primary residence. This means that homeowners can enjoy the benefits of reduced property taxes year after year.

However, refinances, Home Equity Loans, or the purchase of another property may change the status of the homestead exemption. Considering that, it is wise to check the exemption status after such events happen. A property tax bill shows all the exemptions applied to the property, so it’s important to read the final tax bill.

Over 65 Exemptions

Homeowners who are 65 years or older may qualify for an additional exemption. The over-65 exemption provides a higher exemption amount for senior citizens, reducing their property tax burden.

Like the homestead exemption, eligibility requirements, and exemption amounts may differ by county. Contacting your county appraisal district or tax assessor-collector is essential to understand the specific details of the over-65 exemption.

Veteran Exemptions

Texas is known for its strong support of veterans, and this extends to property tax relief. The state offers several exemptions and programs for veterans, including disabled veterans and their surviving spouses.

Under the Disabled Veterans Exemption, property tax relief is offered to veterans with service-related disabilities. The exemption value is based on the percentage of service-connected disability rating, with higher ratings resulting in greater tax savings.

Furthermore, veterans with disabilities unrelated to their military service may also qualify for property tax exemptions based on their disability ratings. These exemptions acknowledge the additional financial burden that disabilities can impose and provide relief to those who have served their country.

We recommend that veterans reach out to their county appraisal district to learn more about the specific exemptions and benefits available to them. These organizations can provide guidance and assistance in navigating the application process.

By taking advantage of the various exemptions and reductions available in Texas, property owners can significantly reduce their property tax burden. Whether it's the homestead exemption, the over-65 exemption, or the veteran exemption, understanding and utilizing these programs can lead to substantial savings.

Paying Your Property Taxes in Texas

Knowing when and how to pay your property taxes is crucial to avoid penalties and interest. Texas property owners have various options for paying their property taxes, ensuring compliance with the tax laws.

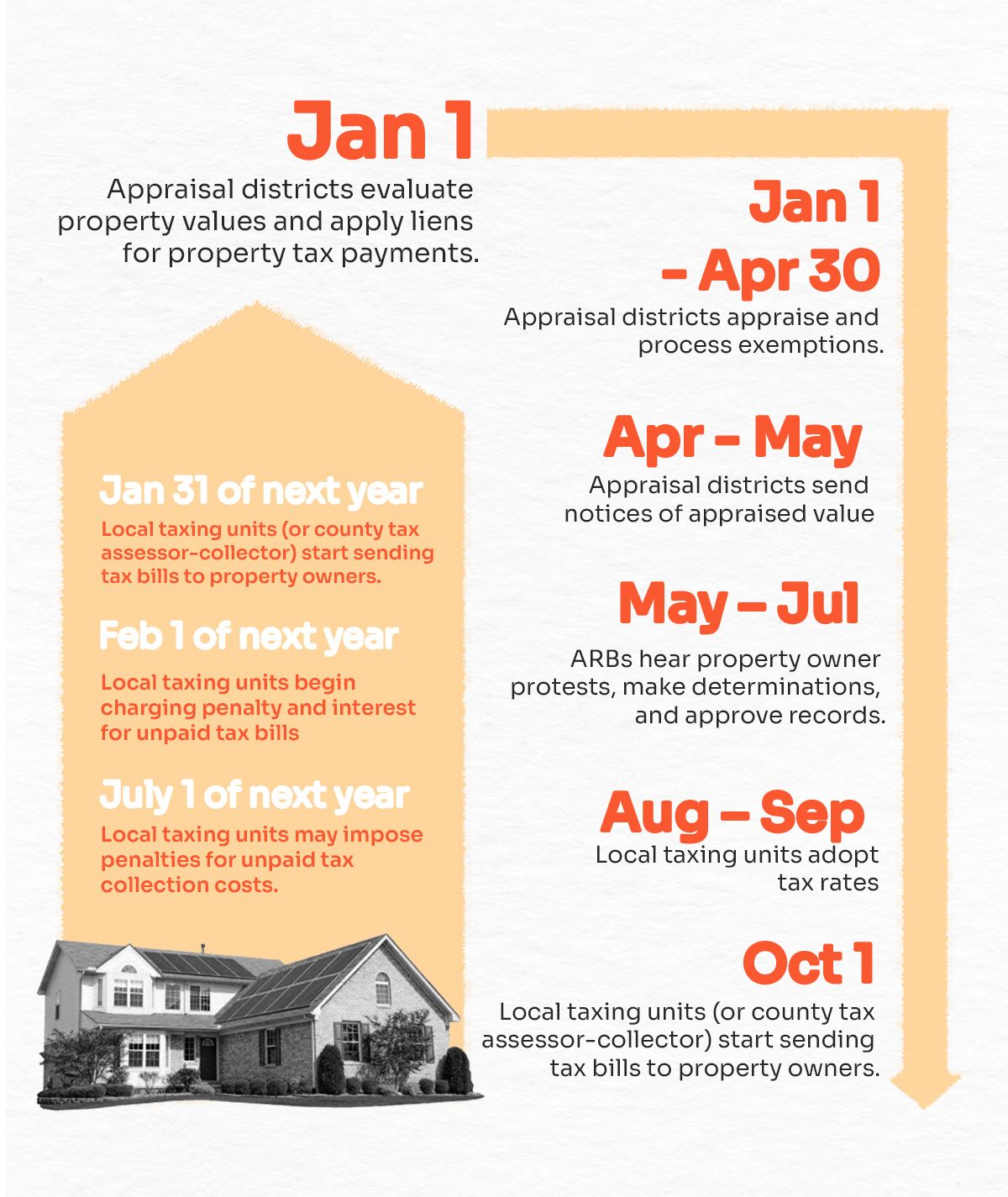

When and How to Pay Your Property Taxes

In Texas, property taxes are typically due in installments. The exact due dates may vary by county, but the most common schedule involves payments in January and June.

You can choose to pay your property taxes directly to the taxing authorities or through your mortgage lender's escrow account. Accepted payment methods may include mail-in checks, online payments, or in-person payments at designated locations.

What Happens If You Don’t Pay Your Property Taxes?

Failing to pay your property taxes can have serious consequences. The taxing authorities have the power to impose penalties, interest, and even initiate foreclosure proceedings if the taxes remain unpaid.

If you find yourself in a situation where you are unable to pay your property taxes, it's crucial to address the issue promptly. Contact your county tax office and explore any available payment arrangements or exemptions that may help alleviate the financial burden.

Frequently Asked Questions About Texas Property Taxes

As property taxes can be a complex subject, it's common for homeowners to have questions. In this section, we provide answers to some frequently asked questions.

Can I Pay My Property Taxes in Installments?

In some cases, Texas property owners may be eligible to pay their property taxes in installments. Contact your county tax office or appraisal district for specific information on installment payment options and eligibility requirements.

For detailed information on paying taxes in installments, check here.

What If I Disagree with My Property Tax Assessment?

If you disagree with your property tax assessment, you have the right to appeal. The first step is to file a notice of protest with the county appraisal district. The appraisal review board will then evaluate your case and make a determination.

Be prepared to provide evidence supporting your claim, such as recent property sales data, comparable properties, or a professional appraisal. If the review board's decision is not satisfactory, further legal remedies may be available, such as arbitration or litigation.

Conclusion: Navigating Property Taxes in Texas

Property taxes are an essential aspect of homeownership in Texas. Understanding how property taxes work, knowing your rights and responsibilities as a homeowner, and exploring any available exemptions or reductions can help you navigate this aspect of homeownership more effectively.

Key Takeaways

Additional Resources for Texas Property Owners

For more information on property taxes in Texas, consult the following resources:

- Texas Comptroller of Public Accounts - Property Tax Division

- Texas Association of Appraisal Districts

- Texas Veterans Commission

Armed with this knowledge, you can navigate the world of property taxes in Texas with confidence, making informed decisions and ensuring proper management of your property-related finances. Remember, understanding your rights, responsibilities, and available resources is the key to financial success as a homeowner in the Lone Star State.